How much gold is there in the world?

The estimated amount of gold over ground existing in the world is 190.931 tonnes, while the estimated amount of gold reserves and resources (gold under ground, unmined) is estimated at 54.000 tonnes.

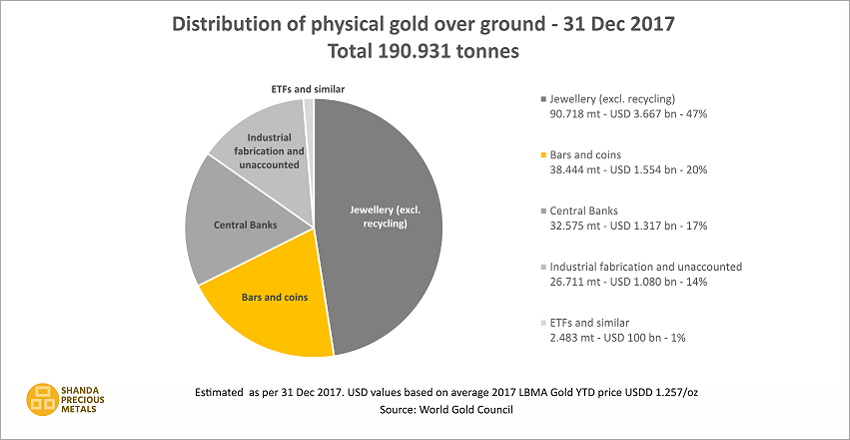

Physical gold in the world

Physical gold over ground, which means physical gold that has been mined until today, is divided in different market segments.

The largest market segment is physical gold in form of jewellery, amounting to 47% of the existing physical gold in the world, almost the half of all gold. Among the demand-driven price-making market factors, gold in form of jewellery plays the most important role. This can often be seen during the end of the summer season, which is the main wedding season in India.

The second largest market segment is physical gold in form of bars and coins in the hands of the private sector, consisting of natural and legal persons. Natural and legal persons invest in physical gold mainly with the purpose of securing wealth, hedging against various risks and accumulating savings.

Gold bars in the hand of central banks represents only 17% of the entire physical gold over ground in the world, but it can have an impact on global gold prices. That is because when central banks buy or sell gold, they do it often in larger amounts.

A good part of physical gold goes to the industry for various technical applications, including mobile phones. For statistical reasons, unaccounted gold is included in this segment.

Exchange-traded funds, shortly EFTs, and similar products that are based on gold account for only 1% of the physical gold over ground in the world. Thus, they play a minor role among the demand-driven price-making market factors.

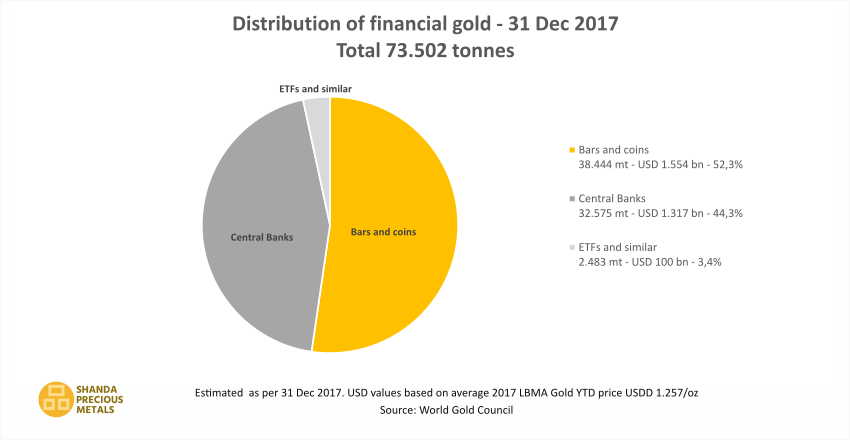

Financial gold

Financial gold is physical gold of the combined market segments gold bars and coins, Central Banks and EFTs. Physical gold of these market segments is called financial gold because they are traded frequently and treated equally to cash.

As seen on the above chart, the total of financial gold was estimated at 73.502 tonnes at the end of 2017 or 38% of all mined physical gold existing in the world.

Gold bars and coins amount to 52,3% of the entire financial gold in the world, thus being an influential factor in the price-finding of the demand-driven gold market.

Gold in the hand of central banks, usually in the form of gold bars, accounts for 44,3% of the financial gold. However, as central banks do not frequently buy or sell gold, this segment plays a relatively small role in the price-finding demand-driven price-finding gold market.

Last but not least, EFTs account for only 3,4% of the financial gold, with naturally little influence by demand.

Under its brand Shanda Precious Metals, Shanda Consults provides services regarding security storage and trade of precious metals such as gold, silver, platinum and palladium. If you like to know more about our services and what makes them outstanding compared with many others, please contact us through below form.