We are watching an extraordinary performance of gold in USD and EUR since 5 months, of 3 months respectively. Gold its on its way to test the 1.300 USD and the 1.200 EUR benchmarks.

The global gold spot price in USD is hiking since 17 August 2018, from 1.172,92 USD/oz to currently 1.275,23 USD/oz today (27 December 2018).

The global gold spot price in USD gained 102,31 USD in 132 days, or 8,72%, resulting in a theoretical annual gain of 24,11%.

Gold denominated in Euro performed even better. The global gold spot price in EUR is increasing since 28 September 2018, from 1.016,151 EUR/oz to currently 1.115,984 EUR/oz today (27 December 2018).

The global gold spot price in EUR gained 99,833 in 90 days, or 8,825%, resulting in a theoretical annual gain of 36,79%.

The sharpest increases could be seen during this December, as the below charts show.

Gold/USD seems to test the 1.300 benchmark, while Gold/EUR tests the 1.200 benchmark, which it already surpassed during the trading hours yesterday and today.

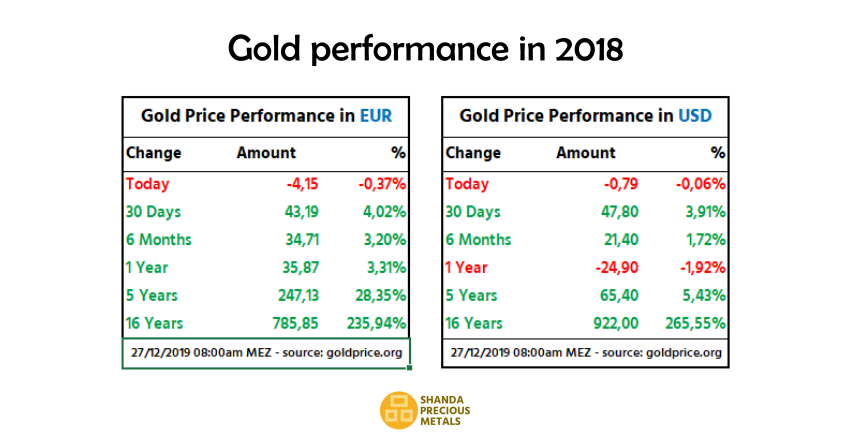

What would happened if I invested in gold x days/months/years ago?

While gold based on USD has had its little flaws in between, it well preserved value in general and thus protected wealth.

Gold based on EUR gained during all terms listed above, except today. While gold in USD just preserved its value in the 5-years term, with a gain of 5,43% (annually 1,09%), gold in EUR gained 28,35% (annually 5,67%).

Thus, gold based on USD and especially gold based on EUR well served the expectations of HNWIs and UHNWIs, who aim to protect their assets from inflation, political decisions and similar risks.

Important warning: Prices of the past do not necessarily repeat in future. Technical analyses may not be correct or even fail under unexpected influential developments in global and national politics, crises, economic developments, natural occurrences etc.

Do only consider investing funds that you do not need for your current life style or to cover your liabilities!