Palladium outperformed all typical investment products during the last 12 months, a trend continuing since February 2009. Based on the figures from yesterday (13 Feb 2019), palladium gained 42,89% during the last 12 months, and 58,73% during the last 6 months. The price of palladium surpassed the price of gold for the first time since 2001. The gain of palladium during the last 10 years is 600%.

About palladium as an investment class

Palladium is a very scarce precious metal. The annual production is around 210 – 220 metric tons (“mt”; US Geological Survey). Palladium is only mined as a small portion of polymetallic ores. Thus, a specific targeting to substantially increase palladium extraction is not possible.

The largest palladium producers are Russia (81 mt), South Africa (78 mt), Canada (19 mt), Zimbabwe (12 mt) and the USA (13 mt), accounting for 203 mt of the global production (all figures for 2017).

The largest known reserves are in South Africa.

Mine closures at the end of 2017 and the beginning of 2018 led to a decrease of production in 2018. Experts expect a further decrease of production by 2% in 2019, says Metal Focus, London. Analysts do not see a possible supply relief anytime in near future.

About 80% of the global palladium production is used in catalytic converters of petrol cars. Tightening of governmental regulations to reduce the output of particle pollution is increasing the production of petrol cars, compared with diesel cars.

The development of electric cars is well going ahead. But electric cars are not expected to reach a level where they could substantially start replacing cars with conventional fueling, for the next five years.

The palladium market is highly volatile, as seen on the above graphic. It seems to be more predictable than other metals, though, due to the fact that about 80% of the world production is consumed by one single industry, the car industry.

However, there is a huge paper palladium market (contracts based on palladium, futures, options etc.) , mainly serving the purposes of advanturers. There are only 42.000 ozs of palladium on the COMEX vaults, but 2,8 million ozs digital obligations.

The below table with a comparison of the main and m

Palladium compared with other investment products

ost common investment products shows the value changes for 12, 6 and 3 months.

The price development of palladium did surpass all other investment products. While palladium gained 41,89% during the last 12 months (as per yesterday), the next highest investment product is Nasdaq 100 with 7,57%, closely followed by gold on Euro (XAUEUR) with 7,49%, and the Dollar Index with 7,06%. The difference between the Dollar Index on the left and right table stems from the little time gap between saving the left and the right table.

Is it too late to invest in palladium?

We do not provide any investment advices of whatever kind. However, as the market situation and the expectation of market experts show, there seem to be still room for substantial gains.

We do provide services for high-security storage facilities for palladium and services for the trade (sell and re-buy) of palladium as well.

Important warning: Prices of the past do not necessarily repeat in future. Technical analyses may not be correct or even fail under unexpected influential developments in global and national politics, crises, economic developments, natural occurrences etc.

Do only consider to invest funds that you do not need for your current life style or to cover your liabilities!

We are watching an extraordinary performance of gold in USD and EUR since 5 months, of 3 months respectively. Gold its on its way to test the 1.300 USD and the 1.200 EUR benchmarks.

The global gold spot price in USD is hiking since 17 August 2018, from 1.172,92 USD/oz to currently 1.275,23 USD/oz today (27 December 2018).

The global gold spot price in USD gained 102,31 USD in 132 days, or 8,72%, resulting in a theoretical annual gain of 24,11%.

Gold denominated in Euro performed even better. The global gold spot price in EUR is increasing since 28 September 2018, from 1.016,151 EUR/oz to currently 1.115,984 EUR/oz today (27 December 2018).

The global gold spot price in EUR gained 99,833 in 90 days, or 8,825%, resulting in a theoretical annual gain of 36,79%.

The sharpest increases could be seen during this December, as the below charts show.

Gold/USD seems to test the 1.300 benchmark, while Gold/EUR tests the 1.200 benchmark, which it already surpassed during the trading hours yesterday and today.

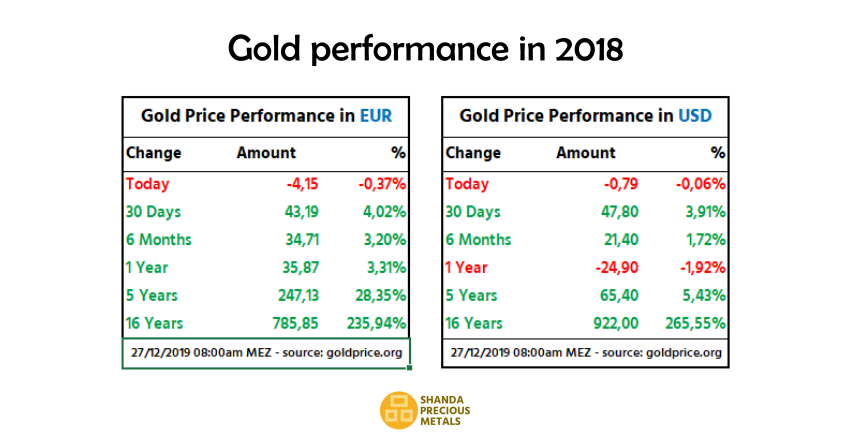

What would happened if I invested in gold x days/months/years ago?

While gold based on USD has had its little flaws in between, it well preserved value in general and thus protected wealth.

Gold based on EUR gained during all terms listed above, except today. While gold in USD just preserved its value in the 5-years term, with a gain of 5,43% (annually 1,09%), gold in EUR gained 28,35% (annually 5,67%).

Thus, gold based on USD and especially gold based on EUR well served the expectations of HNWIs and UHNWIs, who aim to protect their assets from inflation, political decisions and similar risks.

Important warning: Prices of the past do not necessarily repeat in future. Technical analyses may not be correct or even fail under unexpected influential developments in global and national politics, crises, economic developments, natural occurrences etc.

Do only consider investing funds that you do not need for your current life style or to cover your liabilities!

What is the “gold premium” added to the gold spot price?

New gold investors are often wondering about the premium added to the gold spot price. Here you find detailed information about the top-up gold premiums and by what factors they are influenced.

The global gold spot market, like many other markets, is always open, except during the weekends. When the European markets start in the morning, the Asian markets are almost closing, and when the European markets come to an end in the afternoon, the US market opens, and so on. The market price of gold, as of any other commodity or goods, is mainly determined by supply and demand. These markets are called gold spot markets.

As global supply and demand continues 24 hours, except weekends, the gold price changes continuously, depending on the supply and demand of each geographical market.

The supply mainly consists of sales of gold owners such as investors, funds, central banks, insurance companies, private investors etc. Gold supply from production of refineries and scrap smelters plays a relatively small role. The production figures of mines, refineries and scrap smelters are rather a source of speculation than having a determining influence on the market.

The global spot market price of gold can be found online and live, provided by many sources. You will also find the global spot market price of gold on our website.

It is very important to understand what the global spot market price of gold stands for. The gold spot market is the market of the material of gold, without being in any specific physical form such as bars of various sizes or coins. The global gold spot market price is mainly used as a price basis for contracts such as gold future contracts or gold option contracts etc., where physical delivery is not the primary goal.

When a buyer wants to buy physical gold, taking delivery, then a so-called bullion premium is added to the gold spot market price. The bullion premium is simply called “premium” in the industry, or sometimes “mark-up” or “top-up”. The word bullion premium is a bit misleading, because it does not only apply to bullions (bars), but to coins as well.

When gold shall be delivered, it obviously needs to be in a physical form, mainly in form of bars but also coins. The production of bars or coins comes at a cost, and other costs like for transports, insurance, handling etc. must be covered as well. And then there is a profit margin of the seller that shall be covered.

All the above cost factors are covered by the premium, that a buyer of physical gold needs to pay to the seller, on top of the global gold spot market price.

Professional investors or buyers who buy gold, or silver, frequently, are often not talking about the gold price, which is determined by the global gold spot market anyway and does not leave any room for bargaining the price of fine gold. Instead, professional gold investors and gold buyers talk about the gold premium of a seller.

Gold spot price + Gold Premium = Gold Sales Price

The global gold spot market price is not the sales price of gold when a buyer buys gold. The sales price is always the global gold spot market price plus the premium.

There are certain rule-of-thumb standards for the premiums of bars of specific weights and for coins of specific provenience. Those premium standards may vary, depending on a number of factors, such as:

- The form and weight offered, such as bars or coins, and the different weights of bars;

- The volume of gold offered or requested;

- The current market supply and demand situation;

- Global and local economic conditions;

- The national market (country) where gold is bought, and

- The sellers’ own objectives.

Gold premiums – the influence of form and weight

Obviously, it costs a mint much more to produce 1.000 gold bars of one gram each than one gold bar of one kilogram. The same goes for the packing, transport and internal handling, banking fees etc.

For example, two or three employees going to the vault, transferring gold from own stocks to customer stocks, storing these customer stocks in boxes, sealing them, taking note of bar and seal numbers and entering them later into the stock software creates the same costs for ten bars of one kg each as for ten bars of 100 g each. But ten bars of one kg and ten bars of 100 g have a different value. Reflecting these costs to the price results in relatively lower premiums for larger bars and higher premiums for smaller bars or coins.

Although gold premiums may vary based on the factors listed above and explained below, there are some standards of gold premiums for general orientation:

Gold bars of 1 kg: 1,5 – 2,5%

Gold bars of 500 g: 2,5% (rarely demanded)

Gold bars of 250, around : 3% (rarely demanded)

Gold bars of 100 g: 3 – 5%

Gold bars of 50 g, around: 5% (rarely demanded)

Gold bars of 31,1 g (1 ounce): 6% (rarely demanded)

Various gold coins (1 ounce): 5 – 8%

These general rule-of-thumb standards may vary as per the quantity offered or demanded, as per the country where gold is bought, and other reasons mentioned above.

Gold premiums – the influence volume of gold offered or requested

The establishment of a gold seller has to cover certain fixed costs such as overhead costs and payment costs, as mentioned above. If those fixed costs can be spread to a larger amount, the seller can be more flexible with his premiums, still covering costs and realising profit.

The seller’s cost to sell and handle gold bars worth EUR 1,5 million are not six times of the costs selling gold bars worth EUR 250.000. Therefore, the premium for a sale of gold bars worth EUR 1,5 million is likely to be lower than for a sale of gold bars worth EUR 250.000.

Gold premiums – the influence market supply and demand

As with all goods, an over supply on the market drops the prices, and a shortage in supply, because of strong demand, increases the prices. When demand is low, compared with supplies, gold sellers may decrease their premiums in order to attract more buyers.

When demand is high, gold sellers may increase their premiums not only for the reason of increased appetite of buyers, but also to reduce their sales, safeguarding their own stocks in order to be able to meet many buyers’ requests, rather than being sold out within a short period and then watching their own empty vaults, waiting until new deliveries arrive.

While writing this article (December 2018), the delivery time of Swiss refineries is up to 6 to 8 weeks, due to the high demand in physical gold. In times of normal demand or low demand, the delivery time of Swiss refineries is typically 2 days to 1 week.

Gold markets, and silver markets as well, are generally calmer during the summer months, leading to a tendency of slightly lower premiums. When market activities pick up again, typically with the begin of the Indian wedding season in September, the increased volatility results in more buying and selling on the market, which is likely to increase premiums as well.

Gold premiums – the influence global and local economic conditions

Global and local (national) economic conditions are not only influencing the price of gold but, naturally, the premiums as well. The influence on the premium does not necessarily need to be in the same direction as the influence on gold prices. There might be a big demand for gold, which may increase the gold prices. But gold prices may reach or pass acceptance levels in a specific country, leading to difficulties for gold sellers in that country to sell. Consequently, the sellers in that country may drop their premiums.

In countries with a high inflation, like Turkey now, an increasing crowd is trusting gold more than fiat savings (money savings), to preserve their wealth, even if gold demand on a global level stagnates.

Global financial crises like the one caused by Lehman Brothers in 2008, demand in gold and silver increases tremendously, which is reflected to increased premiums as well.

Gold premiums – the influence of a sellers’ own objectives

An individual seller’s own objectives may have an influence on the gold premium, as mentioned above. A concern not to run out of inventory may lead to an increase of a seller’s gold premium. Excessive gold stocks may lead to a lower gold premium of a specific seller.

A seller entering a new market may offer discounted gold premiums to attract more potential buyers. The same typically applies when a seller wants to increase its market share, or to beat strategies of competitors.

Please note that the above information regarding gold premiums applies also to the premiums added to the global spot market prices of silver, platinum and palladium, with the exception that the standard rates are different.

Fiziki Altın ve Gümüșe uzun vadeli yatırım: en emniyetli saklama hizmeti, Avrupa’nın kalbinde.

Fiziki altın ve gümüș, yüzyıllardan beri en güvenilen uzun vadeli yatırım aracıdır.

Fiziki kıymetli madenlere yatırım (bașlıca altın, gümüș, platin ve paladyum olmak üzere), enflasyondan korunmak için en önemli yöntemdir. Örneğin; 1910 yılında ABD’de bir galon benzin 10 US cent’ti, yani USD 0,10. Bu rakam, 0,72 ons gümüș’e eșdeğerdi. 104 yıl sonra, yani 2014 yılında, ABD’de bir galon benzin USD 3,61 değerine yükseldi. Fakat bu fiyatın gümüș karșılığı 2014’te yine 0,72 ons’tu.

Ayrıca, bilindiği gibi, birçok ülkenin Merkez Bankaları tonlarca fiziki altın saklamaktadır ki – para birimlerinin olası așırı bir de değer kaybına ya da bașka ekonomik felaketlere karșı en güvenli önlemdir.

Altın ya da gümüșünüzün hukuki sahibi olmak önemlidir

Fiziki altın ya da gümüșe stratejik yatırım yapan kimseler varlıklarını muhtelif risklere karșı korumak ister.

Ancak enflasyon, korunması gereken risklerden sadece bir tanesidir. Örneğin:

- Bankaların kasa dairelerinde saklanan fiziki altınlar ya da son zamanlarda pek rağbet gören “altın hesapları”na kayıtlı altınların hukuki sahibi bankalardır.

Neden?

%99,99 saflığında olan fiziki altın nakit parayla eșit olarak değerlendirilir ve bu yüzden bankaların nakit varlıklarının arasında yeralmakta ve bankaların bilançolarının aktiflerine kayıtlıdır. Bankalar, kasa dairlerinde bulunan ya da altın hesaplarına endekslenmiș altınlarının hukuki sahipliğini müșterilerine devretse, devredilen altınlar bankanın aktiflerinden ve nakit pozisyonlarından çıkar. Bu durumda bankanın nakit pozisyonları azalıp yasal sermaye-nakit paritesi tehlikeye girer ya da yasal asgari oranının altına iner.

Bu yüzden, bankalar fiziki altın satarken sattıkları altının hukuki mülkiyetini müșterisine devretmeyip sadece kendisine ait olan ve kendisinin bilanço aktiflerinde kalan belirli miktardaki altın için müșterisine bir “hak” verir. Yani, bankadan altın satınalan müșteriye kendine ait olan altın üzerine bir hak tanır. Böylece yasal mülkiyet, bankada kalır. Bir krizde iflas eden bir bankadaki “müșteri” altınları da bankanın varlıkları arasında olduğu için müșteri sözde altınlarını kaybeder.

Dolayısıyla temkinli yatırımcının, altınlarının yasal sahibi olacak șekilde altına yatırım yapması tavsiye edilir. Bu da ancak altınları bankaların dıșında saklama hizmeti veren bir kurulușu tercih ederek mümkündür. - Yukarıda anlatılan sebeplerden dolayı bankalar “sattıkları” fiziki altınları müșterisine teslim etmez, çünkü gerçek yasal sahibi bankadır. İleri yıllarda altınlarınızı bașka bir yerde saklamak istediğinizde bu mümkün olmayacaktır.

Bu yüzden uzun vadeli ciddi yatırımcılar, yine altınlarını bankaların dıșında saklama hizmeti veren bir kuruluș nezdinde saklanmasını tercih eder. - Çok büyük bir risk teșkil etmemekle beraber, satınalınan kıymetli madenlerin sigorta durumuna bakmakta fayda var. Kıymetli madenlerin sigortalanması pek masraflıdır, çünkü sigorta primleri yüksektir. Bu yüzden birçok bankanın sakladıkları kıymetli madenler %100 olarak sigortalı değildir.

Bu riske girmek istemeyen yatırımcı dolayısıyla saklama kurulușunun sigortasından kendisine ait olan kıymetli madenlerin ful sigorta kapsamında olduğuna dair bir teyit belgesini talep eder ya da kıymetli madenlerini kendi namına sigortalatırılmasını talep eder.

Shanda Consult, “Shanda Precious Metals” markası altında Lihtenștayn’de en yüksek güvenlik seviyelerinde bulunan özel binada ve banka sistemi dıșında kıymetli madenler saklama hizmetini sunmaktadır.

Yukarıda değinilen konularla ilgili olarak önemli avantajlarımız:

- Lihtenștayn’deki saklama ve depo șirketi banka ya da finansal kurum olmayıp müșterilere ait olan kıymetli madenleri kendi bilançosunda tutmaz. Kıymetli madenlerini bizimle saklanan müșterilerimiz, kıymetli madenlerinin gerçek yasal sahibidir.

- Müșterilerimiz, kıymetli madenlerini her zaman görebilir, teslim alabilir ya da bașka bir yere nakledilmesini talep edebilir.

- Bizimle saklanan kıymetli madenlerin ful kapsamlı sigortalandığına dair, sigorta tarafından tanzim edilen sigorta teyit belgesi müșterilerimize teslim edilir. Sigorta teyit belgesi müșteri adına tanzim edilir, sigortalı kıymetli madenleri gösterir ve parasal sigorta kapsamını teyit eder.

Fiziki kıymetli maden müșterimizin yatırımları genellikle EUR 200.000’den bașlamasına rağmen daha küçük yatırım planlayan müșteriler de kabul ederiz.

Daha fazla bilgi için așağıdaki formla bize hemen ulașabilirsiniz.

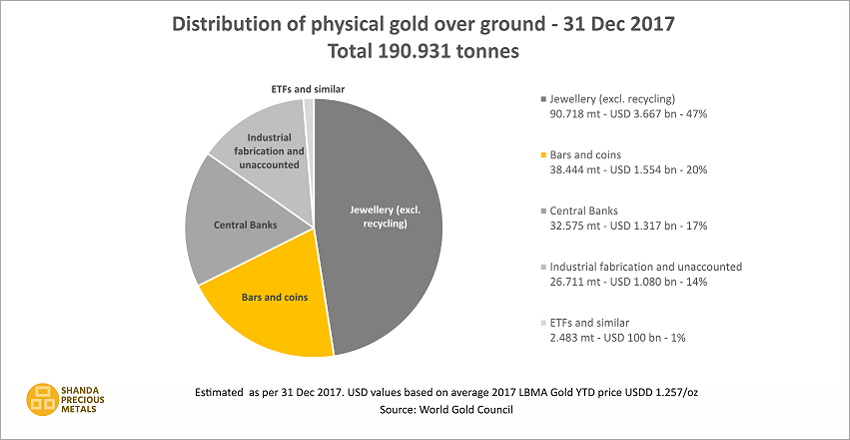

How much gold is there in the world?

The estimated amount of gold over ground existing in the world is 190.931 tonnes, while the estimated amount of gold reserves and resources (gold under ground, unmined) is estimated at 54.000 tonnes.

Physical gold in the world

Physical gold over ground, which means physical gold that has been mined until today, is divided in different market segments.

The largest market segment is physical gold in form of jewellery, amounting to 47% of the existing physical gold in the world, almost the half of all gold. Among the demand-driven price-making market factors, gold in form of jewellery plays the most important role. This can often be seen during the end of the summer season, which is the main wedding season in India.

The second largest market segment is physical gold in form of bars and coins in the hands of the private sector, consisting of natural and legal persons. Natural and legal persons invest in physical gold mainly with the purpose of securing wealth, hedging against various risks and accumulating savings.

Gold bars in the hand of central banks represents only 17% of the entire physical gold over ground in the world, but it can have an impact on global gold prices. That is because when central banks buy or sell gold, they do it often in larger amounts.

A good part of physical gold goes to the industry for various technical applications, including mobile phones. For statistical reasons, unaccounted gold is included in this segment.

Exchange-traded funds, shortly EFTs, and similar products that are based on gold account for only 1% of the physical gold over ground in the world. Thus, they play a minor role among the demand-driven price-making market factors.

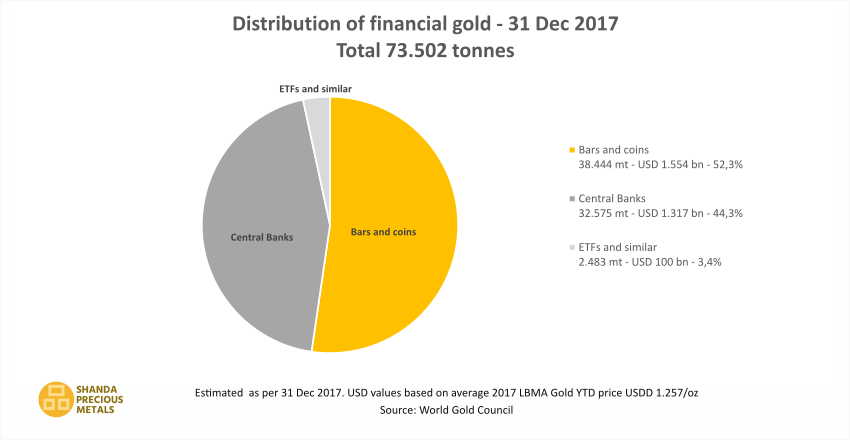

Financial gold

Financial gold is physical gold of the combined market segments gold bars and coins, Central Banks and EFTs. Physical gold of these market segments is called financial gold because they are traded frequently and treated equally to cash.

As seen on the above chart, the total of financial gold was estimated at 73.502 tonnes at the end of 2017 or 38% of all mined physical gold existing in the world.

Gold bars and coins amount to 52,3% of the entire financial gold in the world, thus being an influential factor in the price-finding of the demand-driven gold market.

Gold in the hand of central banks, usually in the form of gold bars, accounts for 44,3% of the financial gold. However, as central banks do not frequently buy or sell gold, this segment plays a relatively small role in the price-finding demand-driven price-finding gold market.

Last but not least, EFTs account for only 3,4% of the financial gold, with naturally little influence by demand.

Under its brand Shanda Precious Metals, Shanda Consults provides services regarding security storage and trade of precious metals such as gold, silver, platinum and palladium. If you like to know more about our services and what makes them outstanding compared with many others, please contact us through below form.

The purchasing power of physical gold and silver – hedging inflation and economic risks

Physical gold and silver are one of the most preferred ways to protect wealth on the long term. As physical gold and silver are outperforming any currency on the long run, they are one of the best solutions to safely transfer wealth to the next generation. Read why…

A few striking examples how physical gold and silver keep value over currencies and other forms of investment:

- Based on USD prices, during the period 1974 to 2014, the cumulative return of physical gold was 3 times of the cumulative return of the S&P 500 Index.

- In the USA, 0,72 oz of silver was buying one gallon of gasoline in 1910, and in 2014 as well. However, the price for one gallon of gasoline in the USA was USD 0,10 in 1910, but USD 3,61 in 2014, an increase of 3.600%.

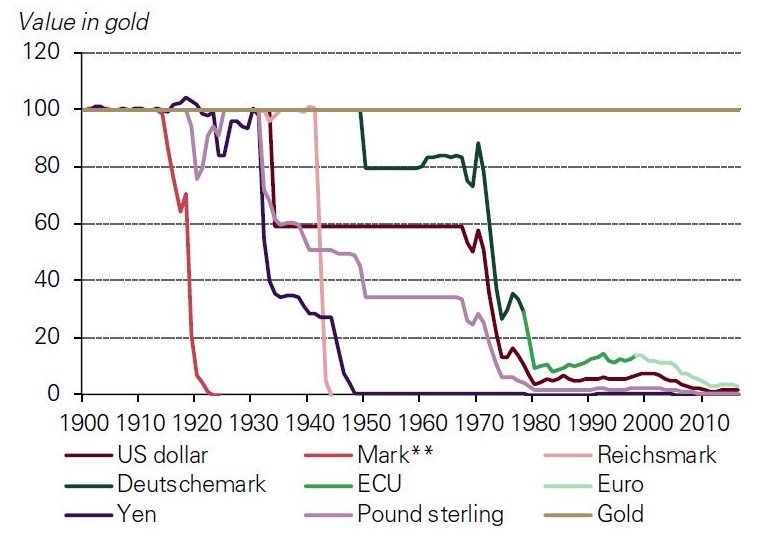

In other words, although the gasoline price increased by 3.600% during 1910 and 2014, the quantity of silver needed to buy one gallon of gasoline is still the same. - From 1900 until 2017, gold outperformed all major currencies, as seen on below chart.

Gold outperformed all major currencies since 1900:

Source: Reuters, Bloomberg

Gold – a century of outperforming currencies

Investment in physical gold is often intended to compensate inflation losses of currencies. The above chart proves the effectiveness of this strategy. Over the last 100 years, gold has heavily outperformed currencies. Global gold production increases 2% annual in average. However, there is no limit to printing banknotes.

Reasons that suggest a substantial rise of gold prices in 2018

Gold analyst Dan Popescu said in April 2018:

“… Gold has recently broken from a technical consolidation formation within a secular bull market started in 2000 ($250) with a potential technical target of $1,450 by the end of the year. Uncertainty in geopolitics with risk of military conflict is gold’s best friend. We had currency wars since 2008, trade wars since 2018 and it looks like military wars are not far. These are ideal conditions for a quantum leap for gold that can push it even above $2,000. Fed’s past chairman Bernanke recently called the present international monetary system “incoherent” and the governor of the Bank of England Carney in 2011 considered the system at a “Minsky moment”. It is I say in unstable equilibrium and ready to collapse and bullish gold.”

More in detail, reasons that suggest a raise of the gold price this year and in future:

- Gold for risk diversification: Gold outperformed the S&P 500 Index since decades. Therefore, owning physical gold is a relatively comfortable way to reduce the general risk of investments by ways of diversification. Investors will continue to diversify their investments by buying gold for their investment portfolio during the next 10 years.

- Growing global gold demand: Gold prices are formed by supply and demand. Growing demand in gold from emerging-market economies does not seem to slow down. Right now, beginning of July 2018, the gold and silver mints in Switzerland and neighbouring countries are not able to offer prompt delivery. When ordering gold from a mint in Switzerland, delivery is around mid of August 2018, and delivery of silver in about three months.

- Need for safety: Gold is perceived as a safe haven in times of crises and economic turmoil. Cautions investors’ choice during such times is physical gold, preferably stored outside of the banking system. Well known large investors, including Carl Icahn and George Soros, are predicting a substantial stock market crash in the near future. If their opinion comes true, many small and large investors will run on physical gold.

- Rising global debt levels: Debt levels of many countries continue to grow rapidly, it seems to be easier to print money then to keep national budgets within limits. When national banknote printing presses continue rotating and when national indebtedness increases, investors get concerned and invest in gold. It is not likely that the problem of increasing indebtedness will be addressed with success during the coming years.

- S. Dollar may be at its peak:Although the US Dollar has slightly decreased recently, it still remains near its highest level since 2003. Political and economic developments may not further support the US Dollar, which would lead to a decrease from its highly supported current level. This will probably increase the demand in gold, as it happened in the past.

- Hedging inflation: During the past, gold prices generally increased with increasing cost of living. This tendency makes gold a good hedge against inflation.

- Negative Interest Rates: Decreasing and/or negative interest rates have always been triggering increase of the gold price, as it becomes extremely difficult to generate any significant gains from currencies or bond yields.

- Wealth protection since centuries: Particularly physical gold, as well as silver, stored outside the banking system, has been perceived as an intrinsic value. This view has recently seen substantial support by a number of central banks, which either withdrew their physical gold from storage facilities in other countries or heavily increased their physical gold stocks by way of purchasing.

The global crises in 2008 opened the eyes of many people. Not only investors had to watch how irresponsible market behaviour can lead to almost catastrophic results around the globe. The current behaviour of the big players on the money and mortgage markets does not create real trust that a major systemic crisis will not repeat. - Gold is liquid and portable: Physical gold with the purity of 999,9 is treated on the markets equal to cash money. Therefore, it is absolutely liquid and can be sold easily.

Physical gold is portable, especially if stored outside the banking system.

Important warning: The above evaluations are the opinion of the authors, which may not materialise in future. The authors do not hold any position in any precious metals at the time of writing this article.

Prices of the past do not necessarily repeat in future. Technical analyses may not be correct or even fail under unexpected influential developments in global and national politics, crises, economic developments, natural occurrences etc.

Do only consider investing funds that you do not need for your current life style or to cover your liabilities!

If you are interested to buy gold for investment or to store your gold with us, please contact us through the form below.

Thank you!